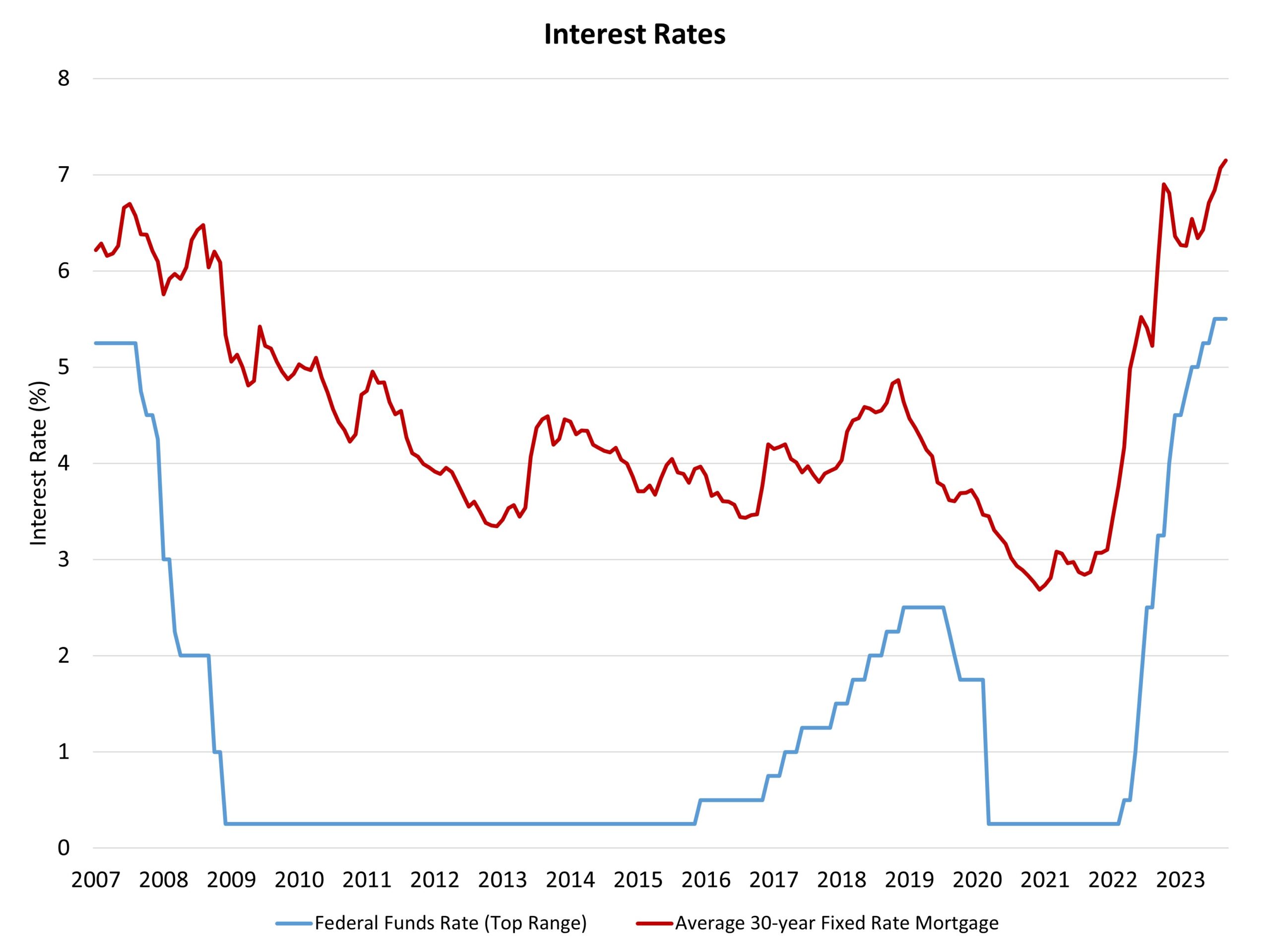

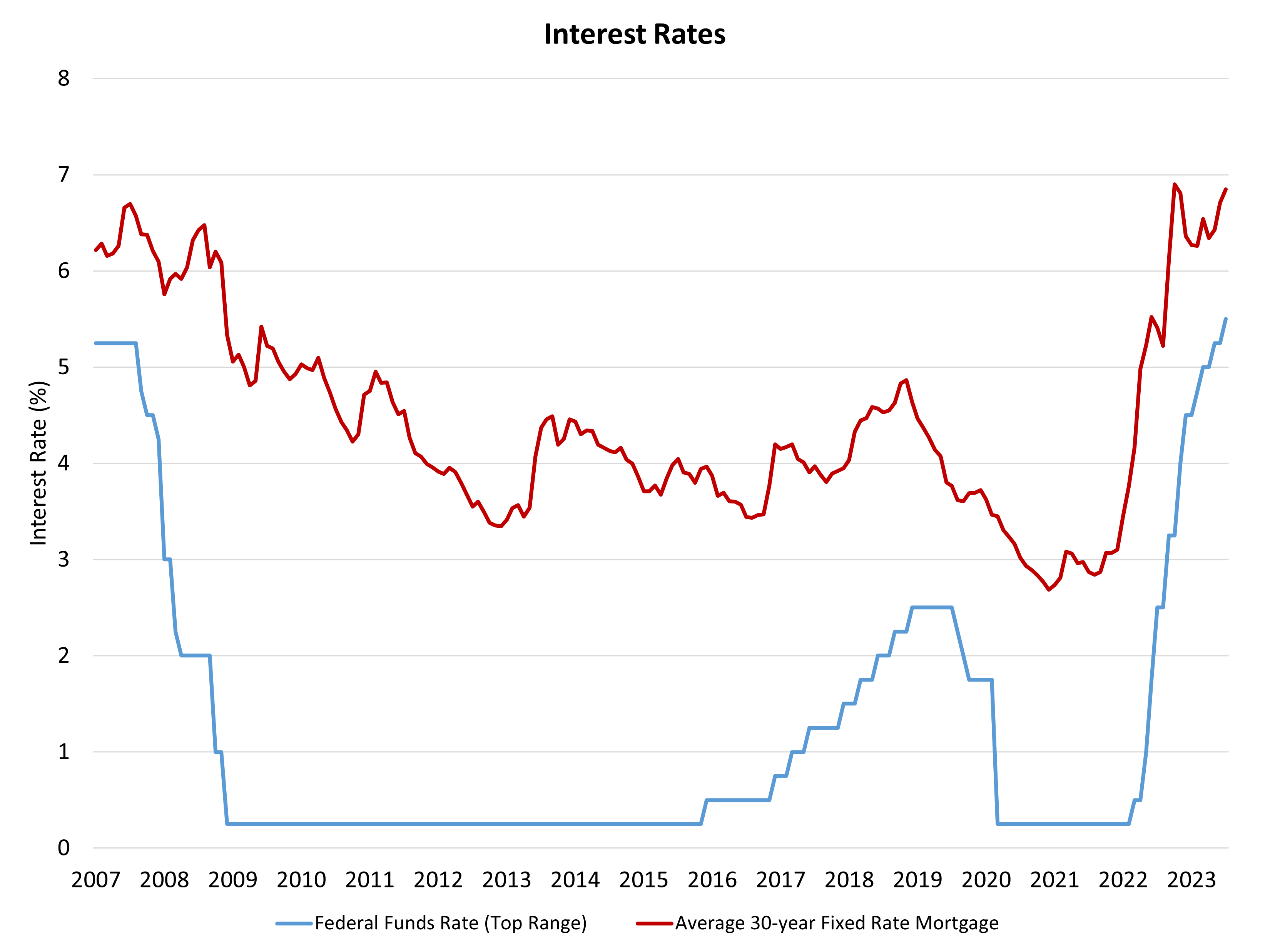

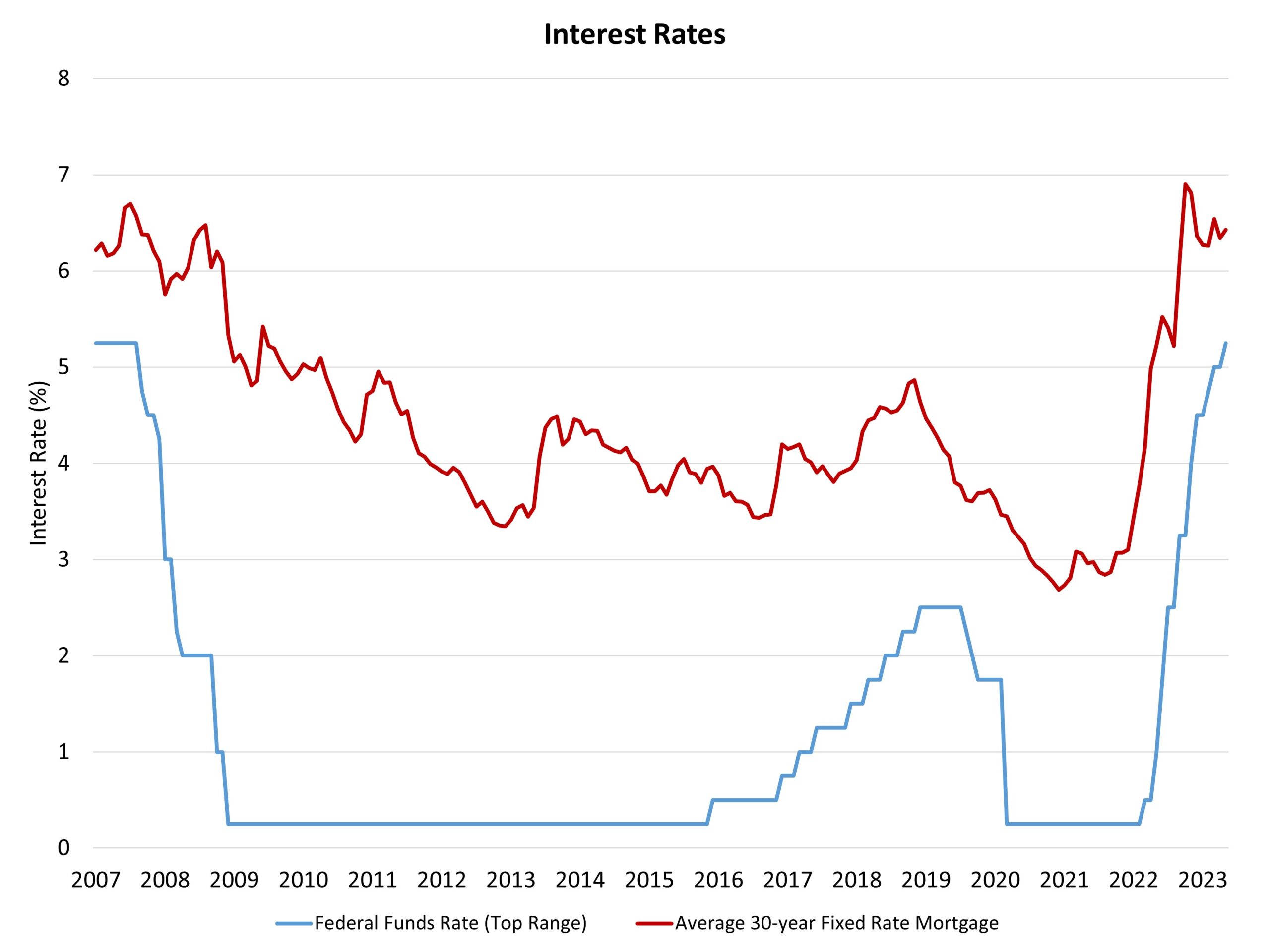

Federal Reserve Rate Cuts in View

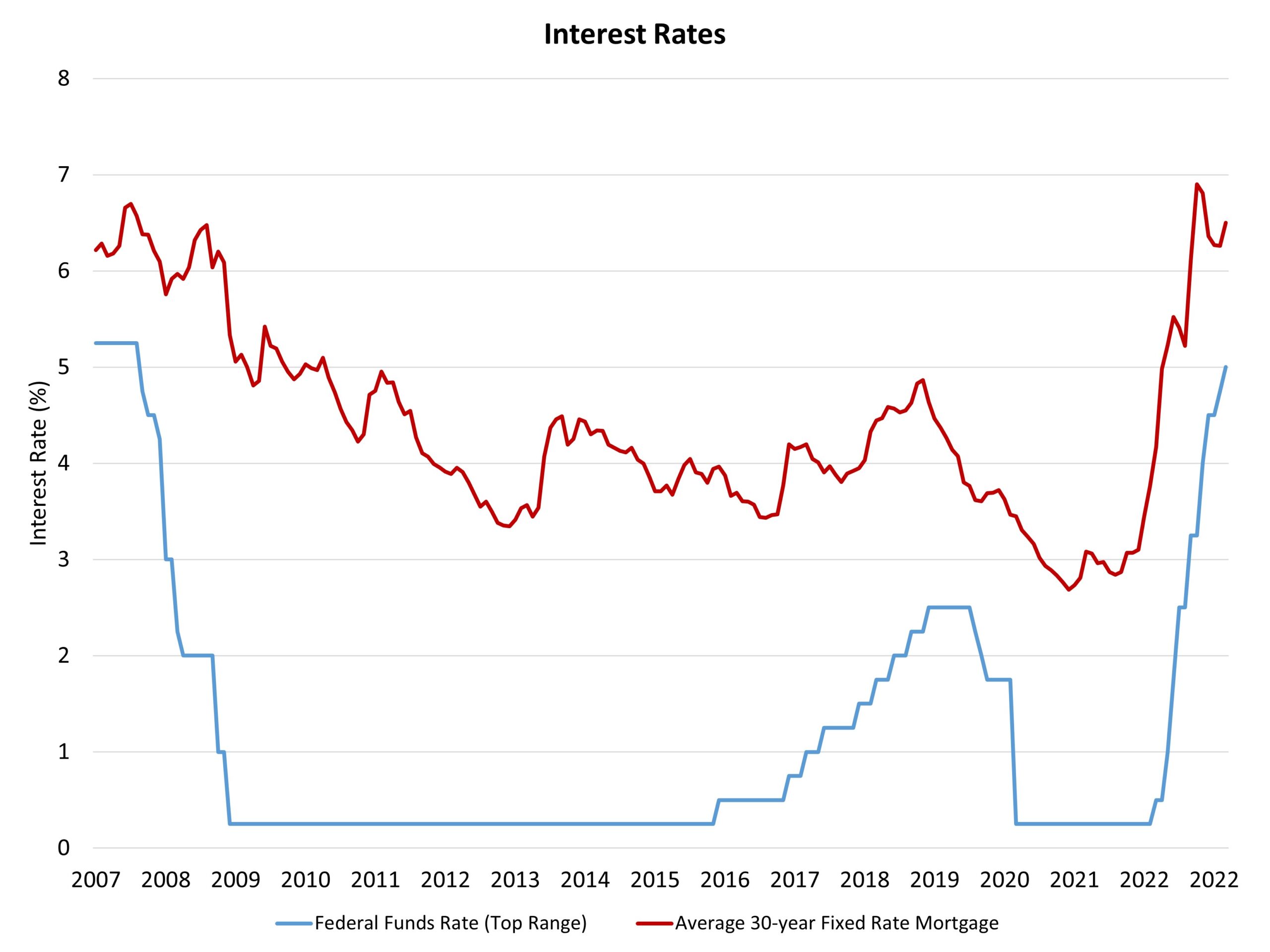

The Federal Reserve’s monetary policy committee once again held constant the federal funds rate at a top target of 5.5% at the conclusion of its July meeting. In its statement, the Federal Open Market Committee (FOMC) noted: “Recent indicators suggest that economic activity has continued…