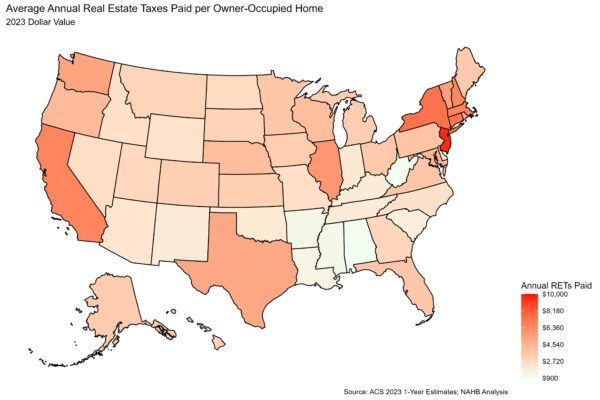

Property Taxes by State – 2023

Nationally, across the 86 million owner-occupied homes in the U.S., the average annual real estate taxes paid in 2023 was $4,112, according to NAHB analysis of the 2023 American Community Survey. Homeowners in New Jersey continued to pay the highest real estate taxes, paying an…