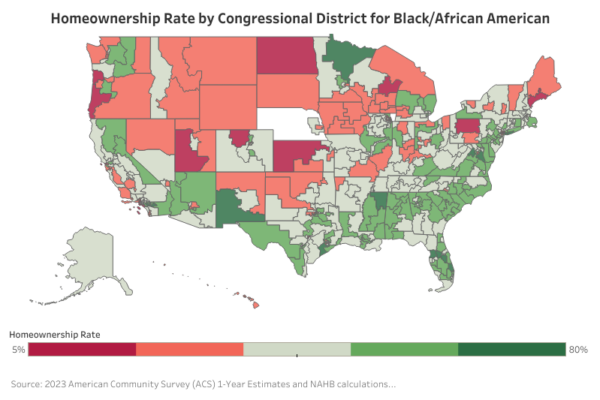

Minority Homeownership by Congressional District

Homeownership is an important voter issue for the upcoming election with both presidential candidates putting forth housing policies to tackle the housing affordability crisis. In a recent NAHB post, the national homeownership rate sat at 65%, but there are large disparities in homeownership when broken…