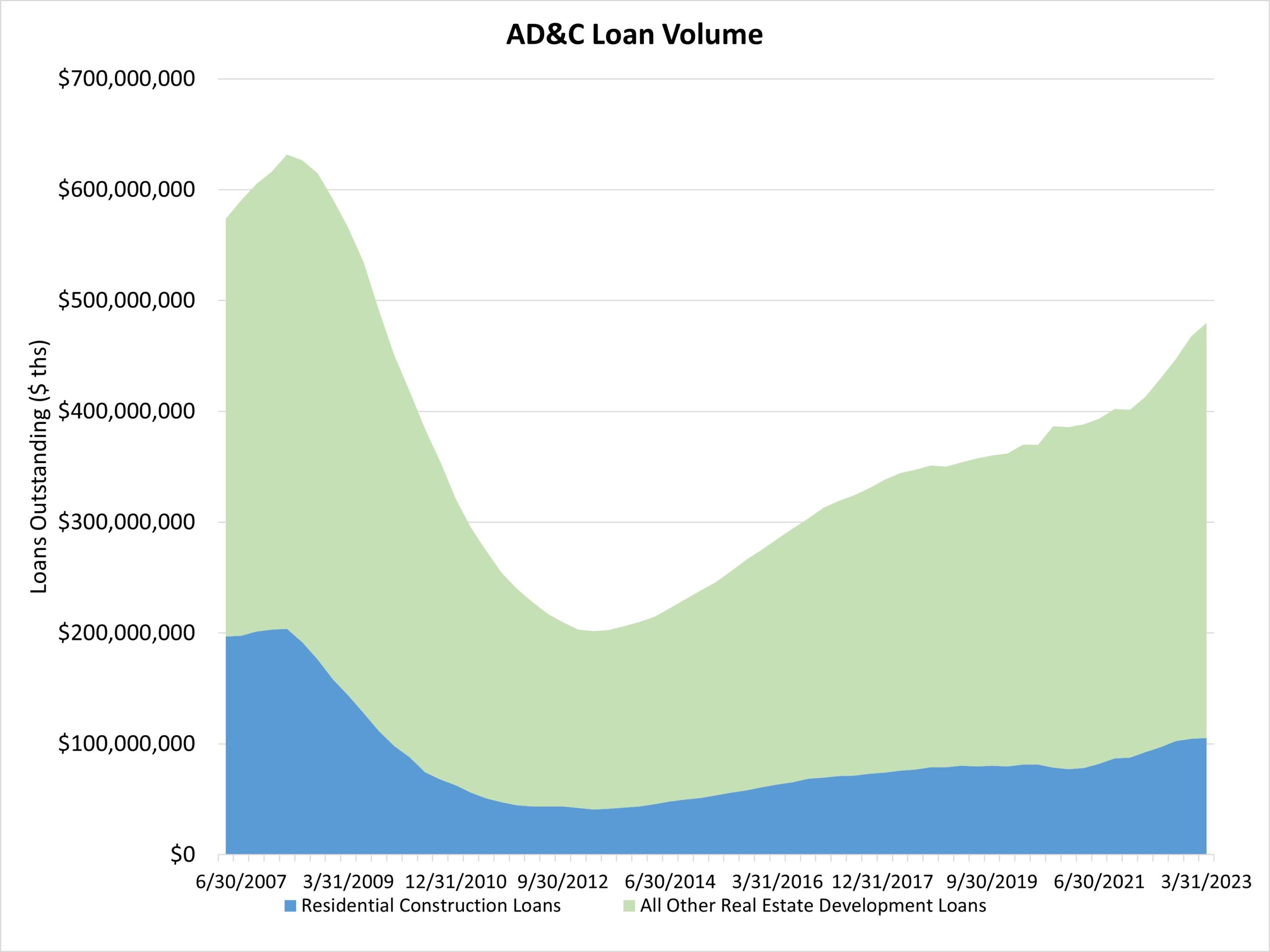

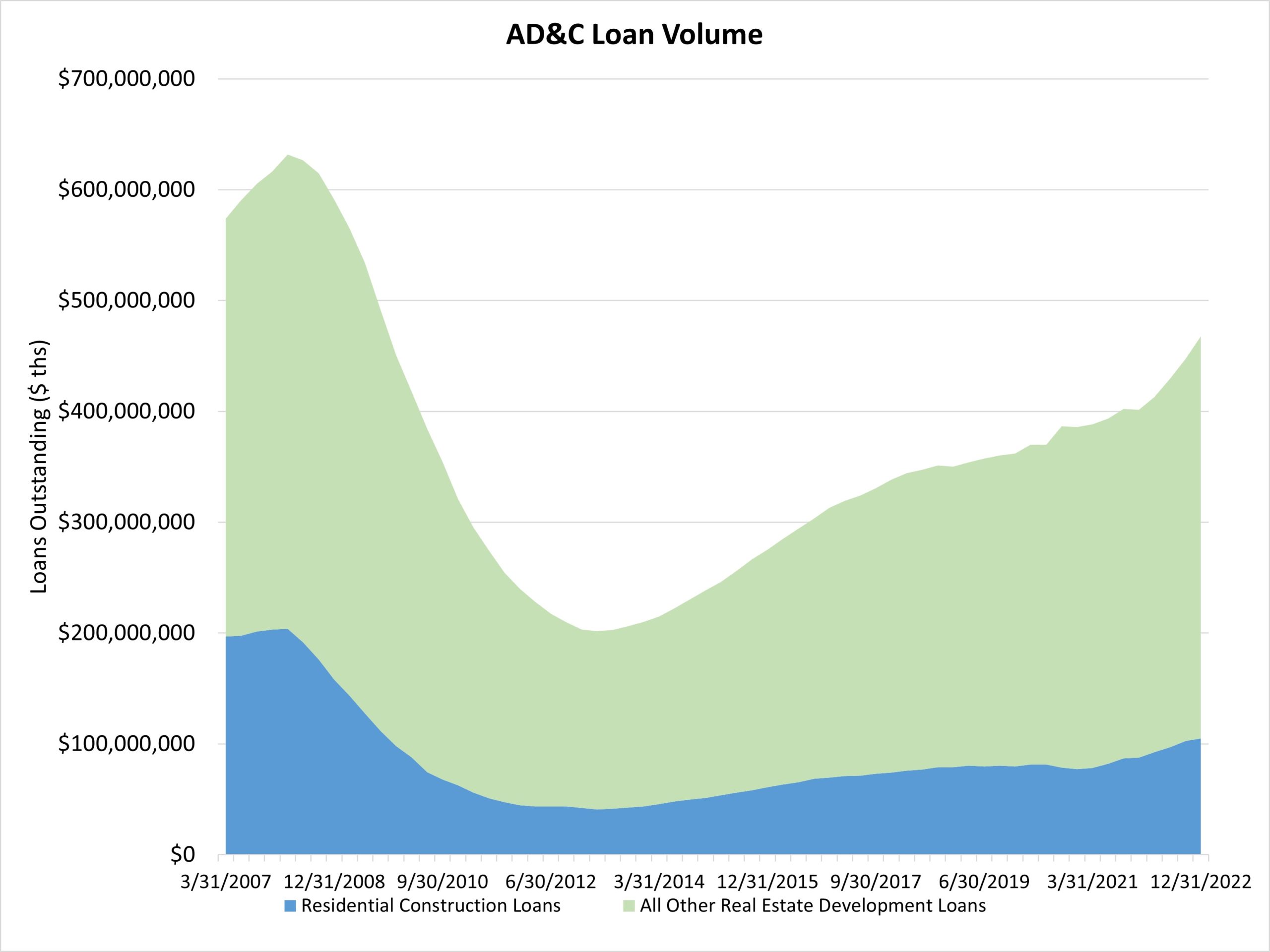

Decline for AD&C Loan Volume in the Second Quarter

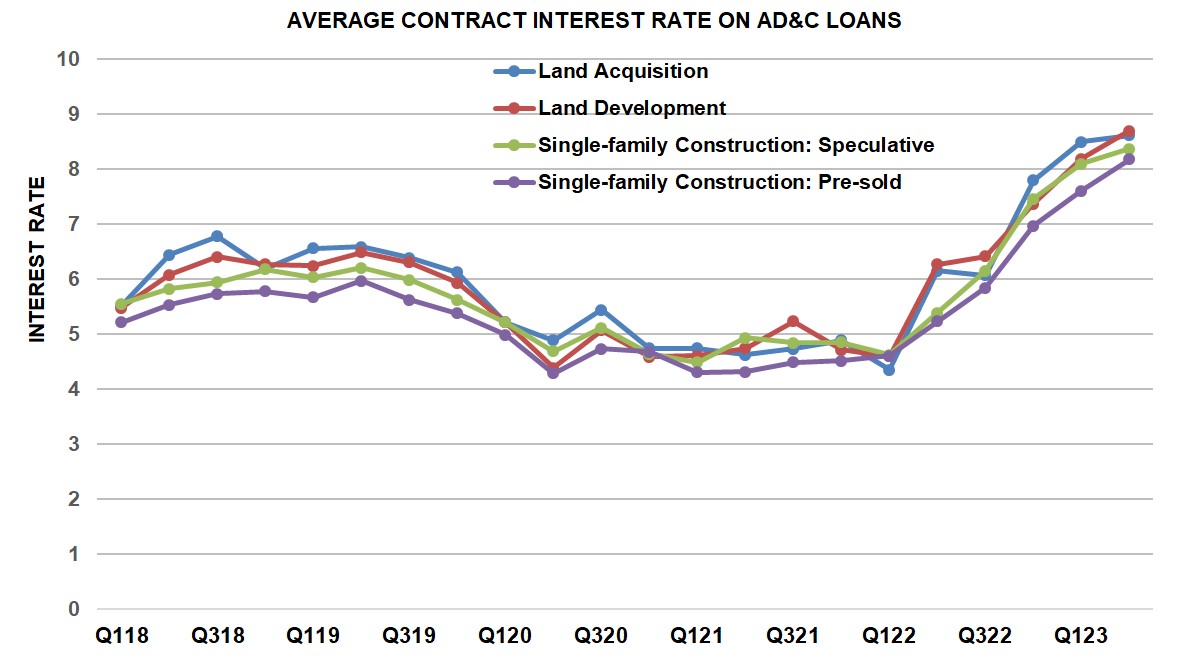

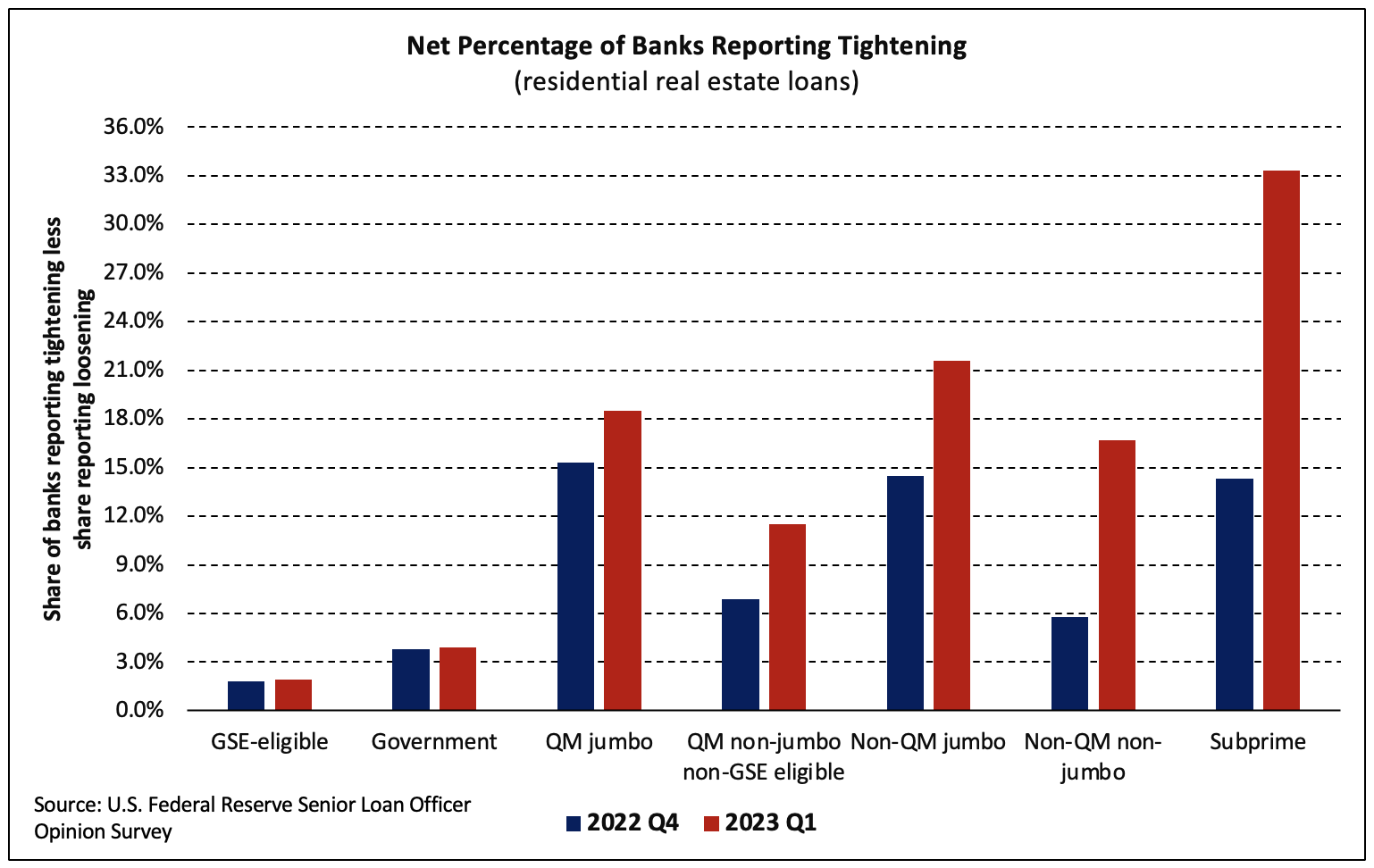

The volume of total outstanding acquisition, development and construction (AD&C) loans posted a decline during the second quarter of 2023 as interest rates continue to rise and financial conditions tighten. The volume of 1-4 unit residential construction loans made by FDIC-insured institutions declined by 2.8%…