Increase in Mortgage Activity for June

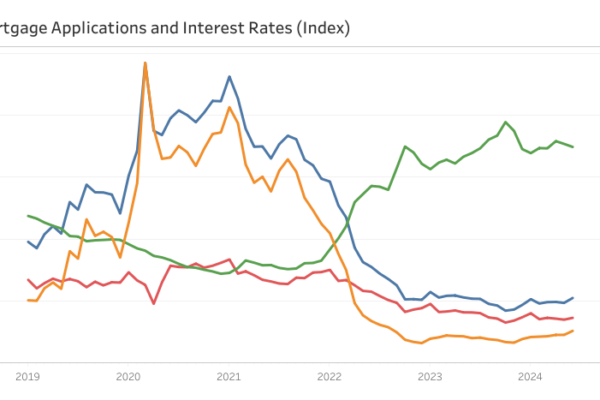

The Market Composite Index, a measure of mortgage loan application volume by the Mortgage Bankers Association’s (MBA) weekly survey, increased by 8.2% on a seasonally adjusted (SA) basis from May to June. In comparison to June 2023, the index is up by 1.0%. The Purchase…